Plug-and-play Solutions

Revolutionize payments, onboarding, and customer interactions with intelligent automation

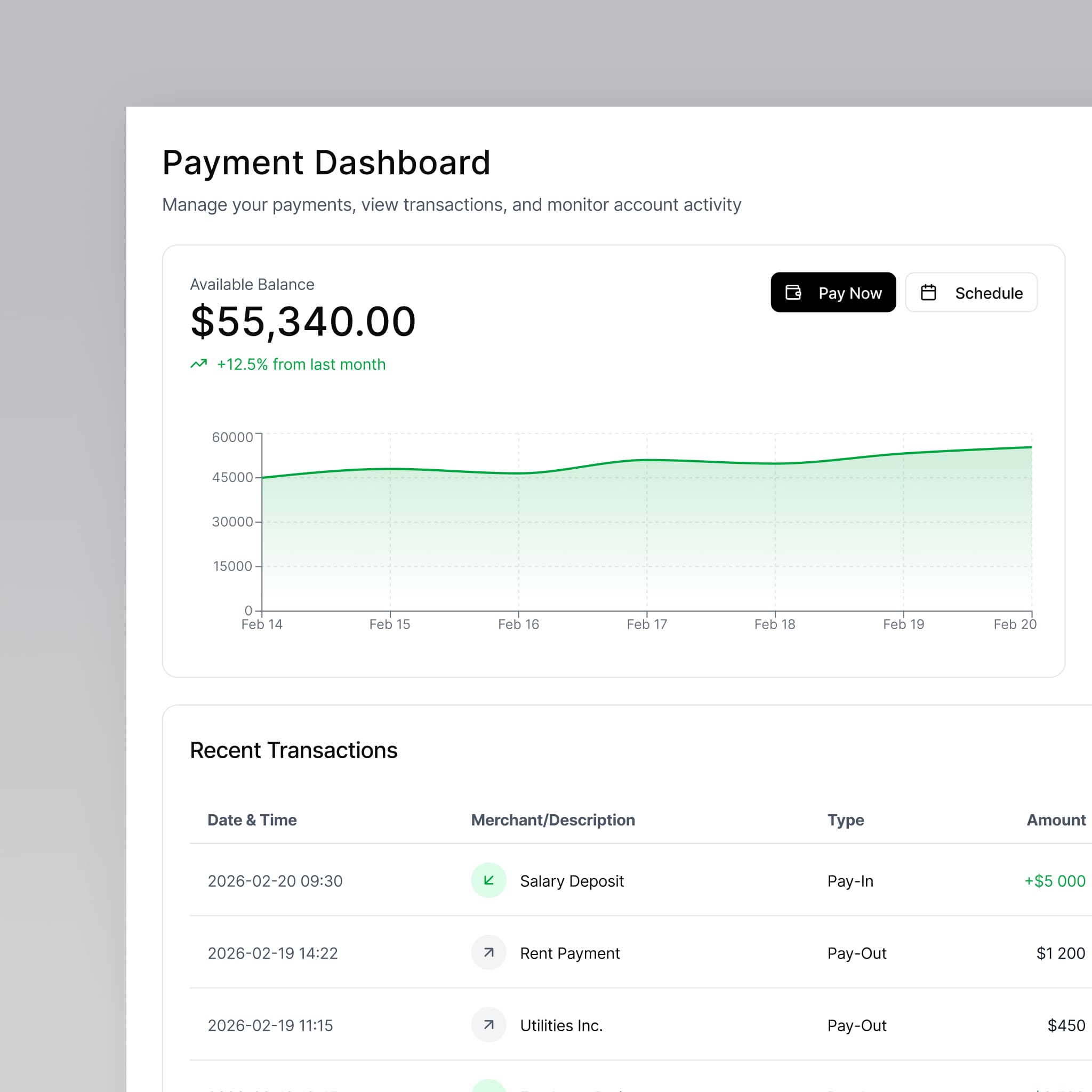

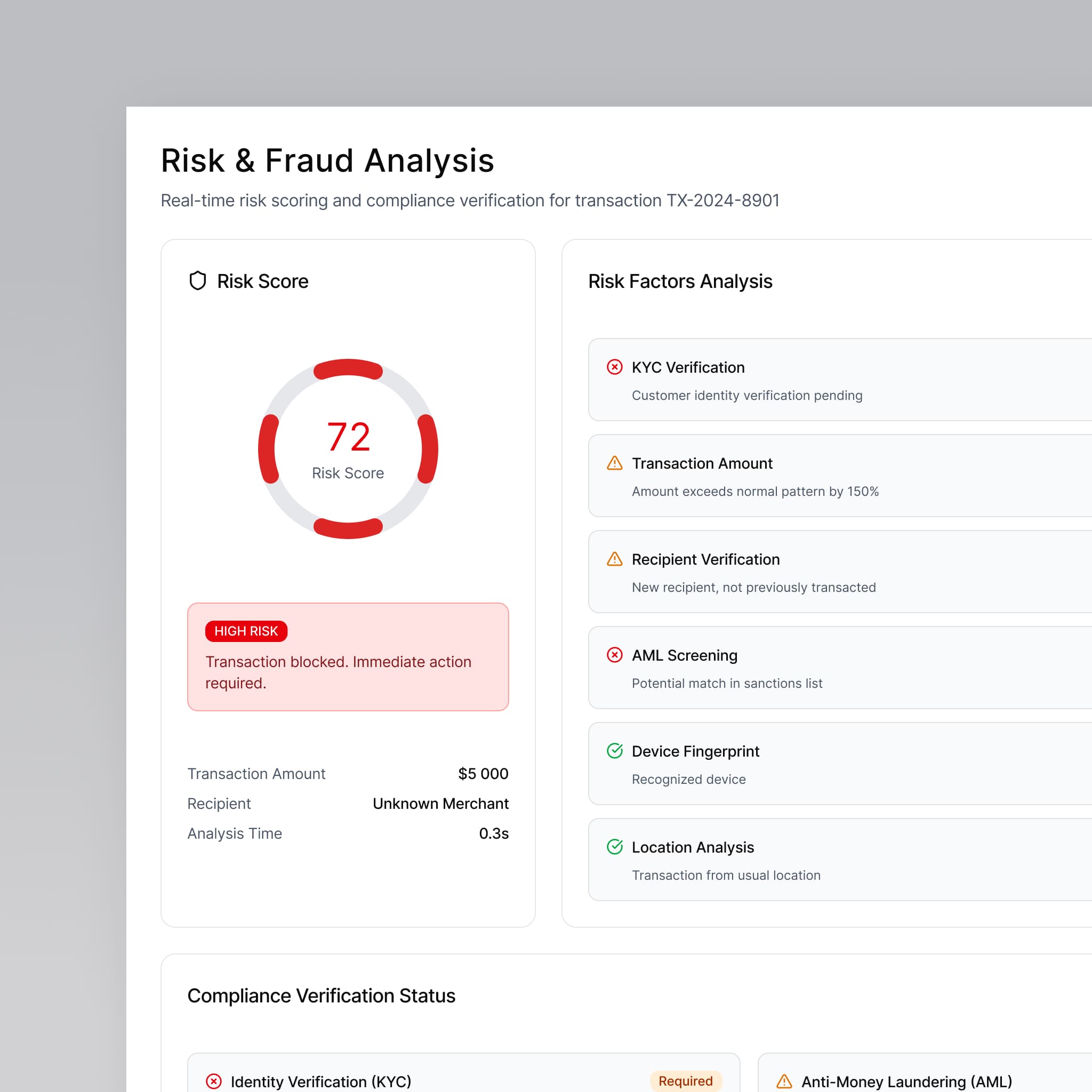

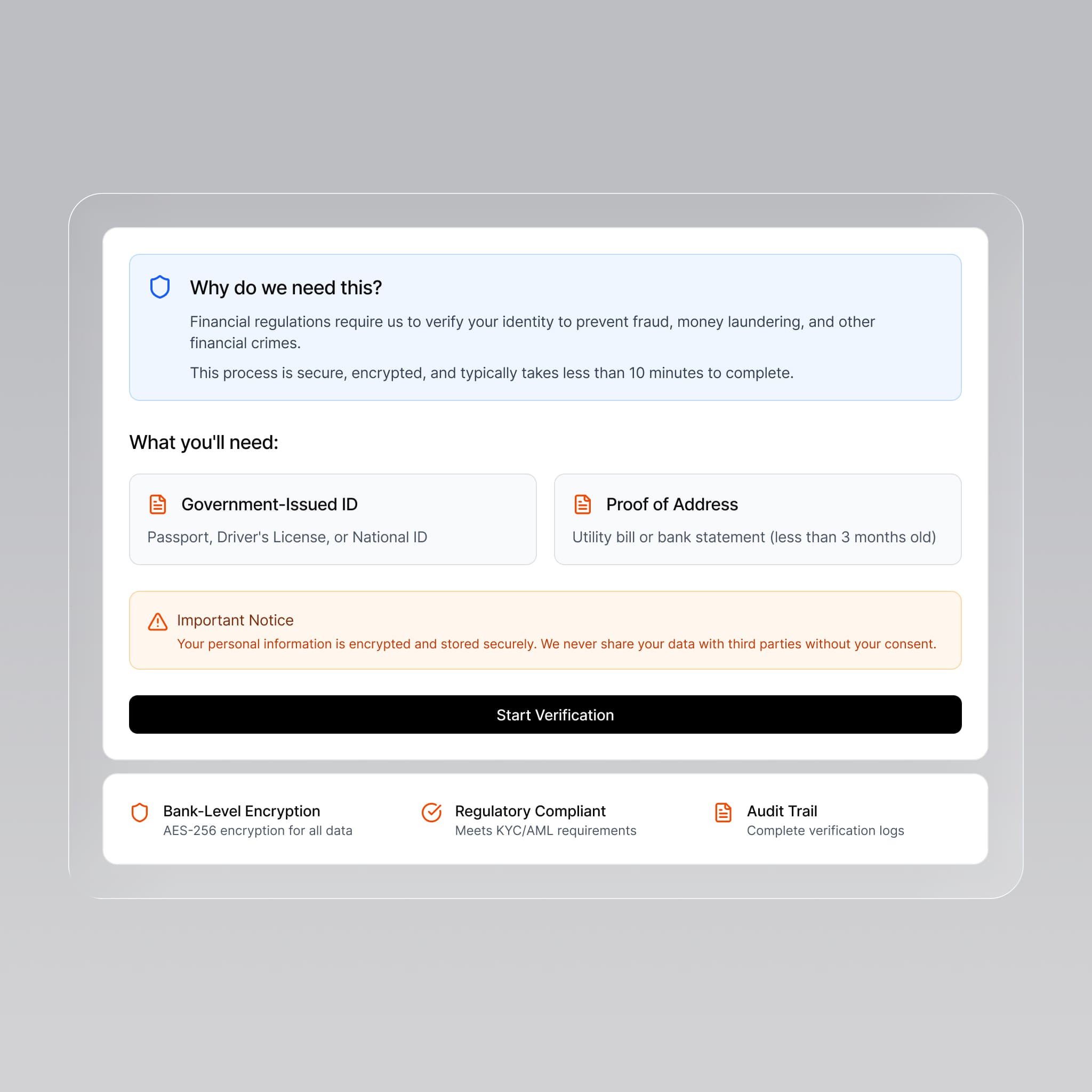

Our custom fintech software development delivers proactive support and real-time insights through a unified payment automation layer

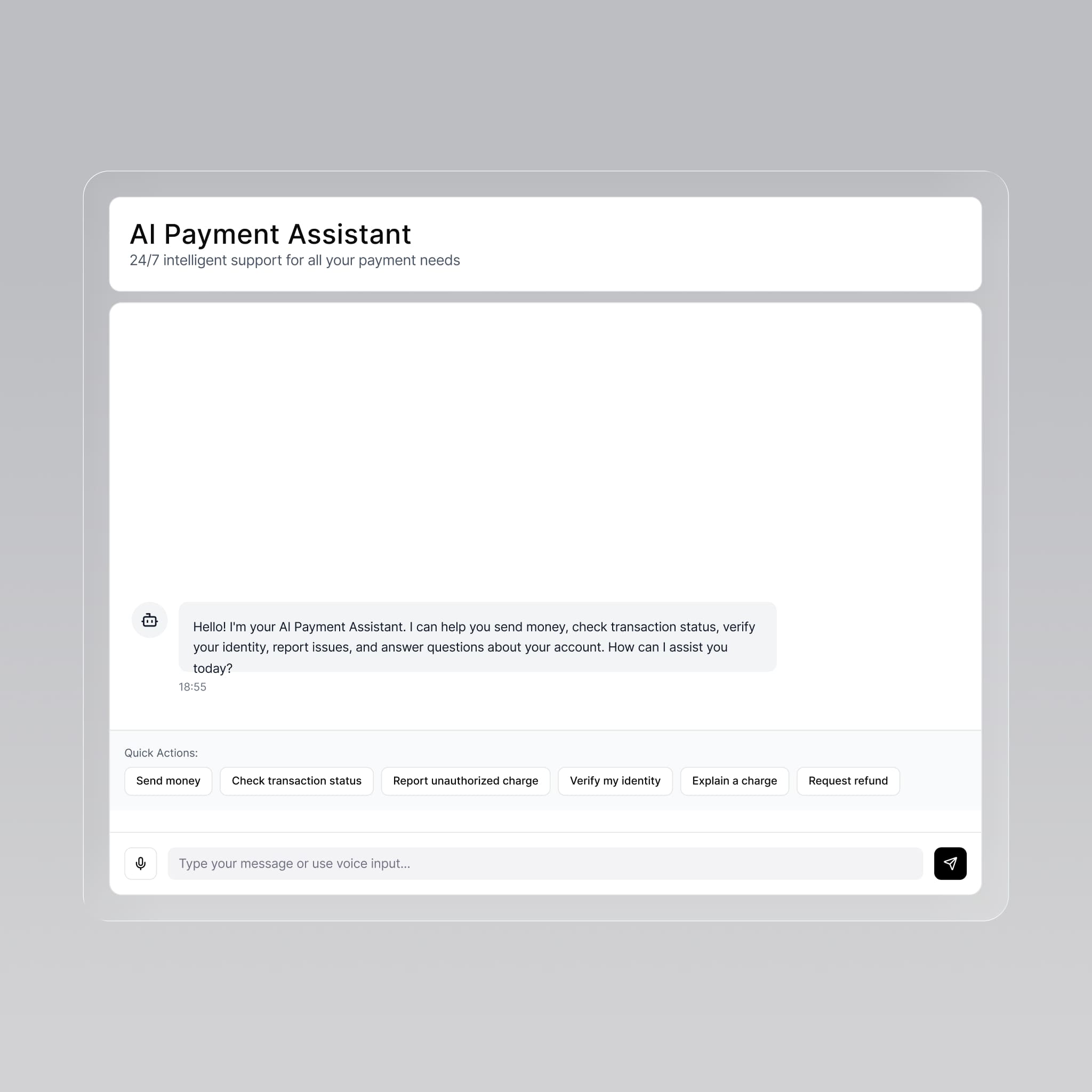

Real-time AI-Powered Payment Agent for Fintech Platforms automating inbound requests and payment actions

Cloud-native AI virtual payment assistant for multilingual voice/chat updates and dispute handling

Predictive intelligence via financial software development services for risk scoring and routing

Seamless integration with digital banking software, core banking, ERPs, CRMs, PSPs, and gateways